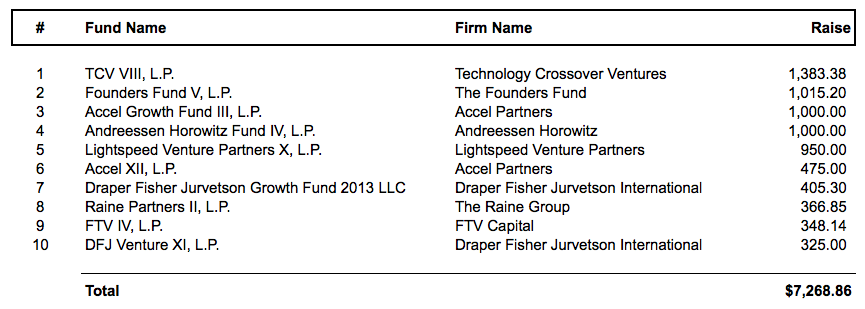

The Top 10 US-based venture capital funds, based on amount of capital raised during the first quarter of 2014, pulled in $7.3 billion over 8 venture capital firms. Accel Partners and Draper Fisher Jurvetson each raised two funds. When it rains it pours.

The first quarter of 2014 was a record breaking quarter and serves as promise that venture capital, as an asset class, is on the ascend. The amount of capital raised in the fourth quarter was up 81% from the fourth quarter of 2013 and up over 100% from the first quarter of 2013. Moreover, the first quarter of 2014 marks the strongest quarter for venture capital fundraising since the fourth quarter of 2007, when $10.4 billion was raised.

Technology Crossover Ventures raised the largest amount of capital at $1,383,380,000 as of March 31, 2014, with a $2,500,000,000 overall target. Second place went to The Founders Fund, while Accel Partners and Andreesen Horowitz shared third place.

All numbers as of March 31, 2014.

The California Gold Rush

California continues its reign as the venture capital state. In fact, all funds in the top 10 are based in California, with the exception of The Raine Group, which is based in New York. Raine garnered the number 8 spot by raising $366,850,000 for its second fund. Coincidentally, Raine counts Marc Andreessen of Andreesen Horowitz as an advisory board member. It looks like his magic may be contagious.

Where is the Money Going?

While the majority of the funds are focused on traditional venture-backed industries — internet, infrastructure, financial services, and software – The Founders Fund has added aerospace and machine intelligence, while Raine is focused on entertainment, media, sports, and lifestyle. Nonetheless, software continues to be the most highly funded sector as we move into a frothy venture capital market.

Strike While the Iron is Hot

There has never been a better time to raise capital. The past two years have been plagued by talk of a Series A crunch leaving entrepreneurs nervous about their future. Finally, it appears the drought is over and entrepreneurs will begin to see the light at the end of the tunnel.

Are you raising capital this year? How optimistic are you about the market?