You’ve heard the age-old adage, “Taking money from a VC is like getting married.” It’s true. The average company exit — whether it is through an acquisition or an IPO — will occur within 8 years of starting a company. Based on a 2009 Census study, marriage exits (more commonly referred to as divorces) typically occur within 8 years of walking down the aisle.

Courting investors bears similarities to courting a mate.

[bctt tweet=”Courting investors bears similarities to courting a mate.” username=”knowyourmetrics”]

Let Them Come to You

If you read, The Rules, you know the key to finding a mate is to keep busy with your own life. This is great advice for startup founders. Investors want you when you’re doing your own thing. Doing your own thing is you hustling to get traction – talking to prospective customers, getting prospects to convert to believers, and letting them tell your story. This is how breakout messaging darling Snapchat was able to hook investor Jeremy Liew. A user mentioned the app was catching on like wildfire and he took notice.

“So Jeremy sent me a Facebook message. I ended up meeting with him and showed him some of the early data we had. That was the month we were not going to be able to pay our server bills any more.” Evan Spiegel, Snapchat CEO

The rest is unicorn history. Of course, this is not always the case. Most entrepreneurs do need to put in a bit of work. But let’s make sure we’re working smart.

Don’t Be a Pervert

On a regular basis, I receive detailed pitches from strangers looking for capital. I’m not writing checks and if I were, I would not write them to strangers. This is the equivalent of asking a married person you’ve never met if they want to go on a romantic get away with you. 1 in 100,000,00 may be interested. Most will find your behavior a bit too forward.

The ideal way to court an investor is to take it slow. Once you’ve identified an active investor in your space, break the ice. You can do this by commenting on his or her blog, following him or her on social media, showing up to hear him or her speak, or by simply sending an email to acknowledge you appreciate his or her work in the space. Building a relationship requires time. Make sure you have a funding timeline that allows you to take required action before you need to actually start asking for capital.

Be Open Minded

Everyone has their tier one dream list. Like Mick Jagger said, “You can’t always get what you want, but if you try sometime you just might find you get what you need.” Finding investors is like that.

It’s okay to create a tier one list, but also create a tier two list and a tier three list. Often times, the well-known funds are not the best fit for your particular idea. You want to focus on finding investors who have domain expertise. That could mean Sequoia or it could mean a fund recently launched by seasoned operators. You might end up pitching to funds you never knew existed. This is fine. In fact, casting a wide net will give you more options to pick from, which leads us to our last tip.

Play Hard to Get

It’s easy to get excited when you receive your first term sheet. Don’t be easy. The worst thing you can do is sign an exclusive, locking you into that specific term sheet. If due diligence doesn’t goes as planned, you’re back to square one.

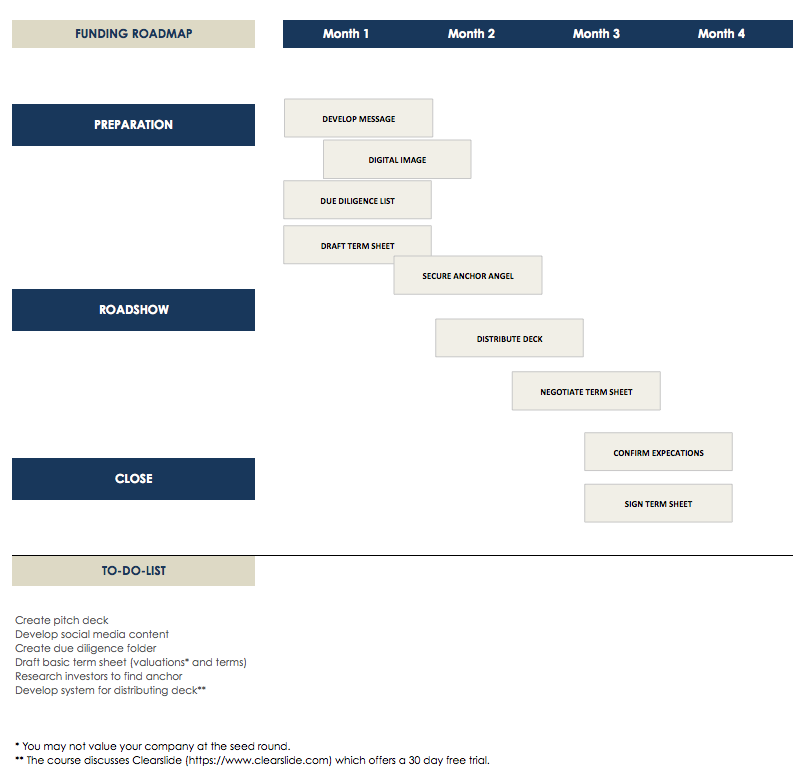

The best strategy is to develop and follow a funding roadmap. It might look something like this:

You can download and modify this roadmap in the course below.

Not all fund raising will occur within four months. You might move your ‘Sign Term Sheet’ block into Month 18. The idea is to have a plan. If you don’t have a plan, you increase your chance of failure.